Several of the benefits as well as functions of Flexi individual loan are stated below. MyLoanCare does not bill any kind of charges for processing your application. Article effective confirmation of your details, the loan provider will certainly pay out the total up to your loan account.

- Whether you want to overhaul your service, launch a new shop, get brand-new machinery, increase functioning funding or surpass your rivals.

- With a Flexi Funding, you can take out the called for amount as many times as you desire, given you stay within the credit limit.

- IDFC FIRST Bank tailor-makes Flexi finances after considering your income, credit rating, and other information.

- In both the cases, the withdrawal process functions in a different way, the Flexi loans offer several withdrawals.

- Utilize the lender's personal car loan eligibility calculator to inspect if you can obtain a flexi loan from them.

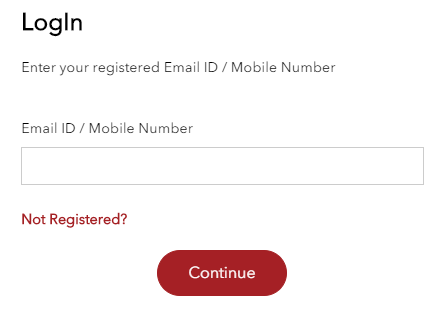

Look for a lending from anywhere in India just by responding to some questions on the site or app. These details will be utilized to evaluate the eligibility for business loan. In terms of the total price of the financing, the EMIs for a term car loan is fairly greater, as the passion is relied on the overall amount. Rather, utilize Flexi lendings where you only have to Discover more here pay interest on the quantity which is taken out. A lot of the Flexi Fundings being used require a minimum set of papers in order to give a line of credit to both salaried and also independent specialists.

Despite the factor, a personal car loan can assist individuals in times of demand. Financial institutions easily provide this product as the procedure to get it is often problem-free. However, what individuals typically disregard to take into consideration is the high rate of interest normally incurred by individual lendings. It offers immediate disbursal, making funds readily available when the demand occurs. Effectively, we pre-screen your application to see to it you are most likely to certify based on the lender's credit scores standards. Therefore, the chance of your individual financing application obtaining accepted is greater.

Monetary Tools

You must fulfill the Westpac Flexi Funding eligibility needs as discussed on this page to be qualified for the funding. Westpac will certainly consider your entire monetary circumstances such as your income, financial debt, employment as well as various other economic info when making a decision to authorize you for a financing. A personal lending from $2,001 to $75,000 that differs based upon your credit rating as well as economic circumstance. Gain as much as 50,000 Qantas Points with an individual lending from Symple. Visit the carrier's website directly, or compare other choices.

Attributes And Also Advantages Of Bajaj Finserv Individual Car Loan

It is wise to choose borrowing alternatives that let you commit excess funds toward minimizing your fees in a beneficial manner. This can save you a great deal of money that you can make use of to attend to other obligations. Luckily, with the Flexi Financing attribute, you can part-prepay your finance at no added fee as well as greatly minimize your general rate of interest outgo.

Additionally, looking for such a funding online likewise just takes a few mins. Flexi Loan meaning is an individual finance that includes a pre-approved loan limitation from which any type of amount can be taken out as and when the demand develops. With a Flexi Financing, you can withdraw the needed amount as lot of times as you want, offered you remain within the credit line. It, therefore, allows you to obtain very easy access to funds at once of financial emergency situation. Interest is additionally dealt with and also relates to the entire finance quantity, IDFC FIRST financial institution gives you accessibility to personal car loan EMI calculator to make sure that you can compute your month-to-month installations. You have to just pay interest on the amount you have actually obtained as well as not the sanctioned funding amount.

Below's all you need to understand about flexi car loans India and also how to avail of them. For a routine personal funding, the tone is a collection repayment duration during which you need to settle your fees in EMIs. Lots of financial institutions and NBFCs provide versatile tenure on finances, the whole lending quantity and also interest obtains separated across the whole tenor and the very same amount in EMIs.